Two age-old European trading rivals are at loggerheads again—this time over SPACs

- Posted May 20, 2021

- 7:25 am

Posted by The Chairman

Source:

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.

The gloves are off as London tries to fight off attempts by Amsterdam and other EU capitals to steal its crown as Europe’s leading financial center post-Brexit.

Britain on Wednesday unveiled proposals for a shake-up of listing rules to make London a more attractive venue for offerings of shares in tech companies and for the red-hot market for blank-check publicly traded companies, or SPACs.

The changes are partly a response to growing evidence that London’s once undisputed dominance as Europe’s financial capital is being eroded after it definitively left the European Union’s orbit on Dec. 31.

Amsterdam knocked London off its perch as Europe’s biggest share trading venue in January and London’s share of trading in euro-dominated interest rate swaps has plunged as business has shifted to EU capitals and the United States, according to IHS Markit.

Rubbing salt in London’s wounds, Amsterdam is also shaping up to be the European frontrunner in the fast-growing market for listing SPACs (special purpose acquisition companies). “SPACs are clearly gaining momentum in Europe with Euronext taking a leading position,” Rene van Vlerken, head of listing at Euronext Amsterdam, says in a promotional video on the exchange’s website alerting the markets that it wants the world’s SPACs.

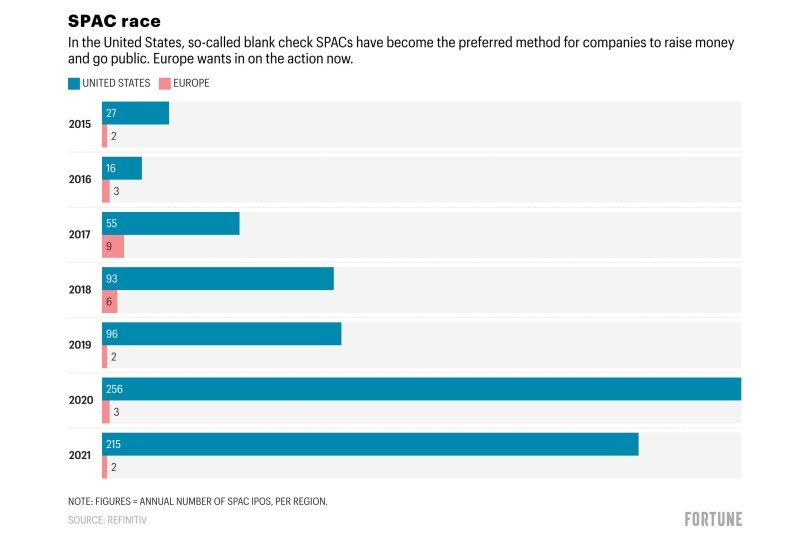

SPACs are cash shell companies set up with the aim of acquiring another company in a particular sector. The SPAC sector is booming in the United States, but Europe lags behind.

ESG Core Investments, a SPAC focused on the environmental, social and governance area, chose Euronext Amsterdam for a €250 million ($300 million) initial public offering in February, the first European SPAC to list this year.

Meanwhile, in London, the four SPACs that listed in 2020 raised a measly 30 million pounds ($42 million).

A SPAC a day (at least)

It’s no wonder European markets are drooling at the prospect of grabbing a bigger slice of the SPAC pie.

Fifty acquisitions by SPACs were announced worldwide last month, the highest monthly tally of all time, financial data company Refinitiv said. The combined value of those deals was $108.6 billion, also a record.

Some 175 SPACs have raised $56 billion in IPO capital so far this year, an average of $1.5 billion per trading day, Goldman Sachs said in an investor note on Monday. Goldman estimated that $103 billion in SPAC capital was actively searching for an acquisition target, and said SPACs could generate more than $700 billion in acquisitions in the next two years.

The big reason? SPACs offer a quicker and simpler way to a public listing than the traditional IPO route.

Removing obstacles

In the U.K., Jonathan Hill, a former top EU official, delivered a series of recommendations aimed at tackle the obstacles that have put off some tech firms and SPACs from floating in London.

Currently in the U.K., trading in a SPAC may be suspended when it announces an intended acquisition. Hill called for this rule to be revised, saying it deterred potential investors in U.K. SPACs who feared being “locked in” to an investment that they wished to exit.

Hill also recommended allowing dual-class share structures and lowering the minimum free float to 15 percent from 25 percent to allay concerns among tech entrepreneurs that a public listing could lead to them losing control of their companies. (Just today, London won one of the most hotly anticipated IPOs of the year—that of Amazon-backed food delivery service Deliveroo, which will adopt the dual-class structure.)

Some investors have voiced fears that the proposals could lead to the weakening of investor protections.

Russ Mould, investment director at stockbroker A.J. Bell, urged caution, saying, “we’ve seen SPACs feature in stock market bubbles from 1720 to 2007.” Britain’s Financial Conduct Authority watchdog, which will now consider the recommendations, should not be swayed by fear of missing out on the SPAC boom, he told the BBC. “It’s got the balancing act of maintaining quality control while fostering the right environment for companies.”

A major pillar to the U.K. economy

Although financial services account for seven percent of the U.K. economy and employ over a million people, they were largely left out of a post-Brexit trade agreement between Britain and the EU. Both sides have so far failed to reach an agreement on “equivalence,” or recognizing each other’s regulation of financial services, meaning London-based banks cannot sell their services in the EU.

Losses of market share by London so far pale in comparison with another sector that is emerging as a key area of rivalry and potential conflict between the U.K. and the EU, which is the $100 trillion London market for clearing euro-denominated derivatives—the behind-the-scenes settling of derivative trades.

The EU has granted temporary permission for clearing to continue in London for now, but has made no secret of its longer term desire to see the business shifted to EU territory.

About a quarter of this trade involves EU-based banks with the rest involving banks based in the U.S. and elsewhere.

The governor of the Bank of England, Andrew Bailey, said last month that any attempt by the EU to persuade banks to move that 75 percent of clearing to the EU through extra-territorial legislation or threats of penalties would be highly controversial and something the British authorities would “resist very firmly.”

Financial services firms, meanwhile, have moved 7,600 jobs from London to the EU, with Dublin and Luxembourg the most popular destinations, according to consultants EY.

Since British voters chose to leave the EU in a 2016 referendum, 24 financial services firms have said they will transfer almost £1.3 trillion ($1.8 trillion) of U.K. assets to the EU, it said.

Some prominent figures in London’s financial services sector, including Hill, hold out little hope that the EU will make significant concessions to the U.K. on “equivalence,” but he believes London can thrive regardless.

Others say Britain should focus on competing outside Europe.

“I think what London needs to be focused on is not Frankfurt, not Paris. It needs to be focused on New York and Singapore. Brexit gives the U.K. the opportunity to define its own agenda … Staying competitive with other markets outside of Europe (in financial services) is really what the government here should be focused on and I think that is what they are focusing on,” Jes Staley, the American CEO of British bank Barclays, told the BBC last month.

More must-read finance coverage from Fortune:

- When are $1,400 stimulus checks coming? It could be this month

- 13 years after investing in an obscure Chinese automaker, Warren Buffett’s BYD bet is paying off big

- The great post-Brexit jobs hit is bad news for Britain’s banking sector, but not terrible

- The vacation from required minimum distributions on retirement plans is over

- No such thing as a free trade: How Robinhood and others really profit from “PFOF”—and why it harms the markets